In this podcast, Marlon Wilson interviews with Chris Bruce (Host of Escape The Newbie Zone) about running a million dollar real estate business! Check it out here!

Tag Archives: Houston

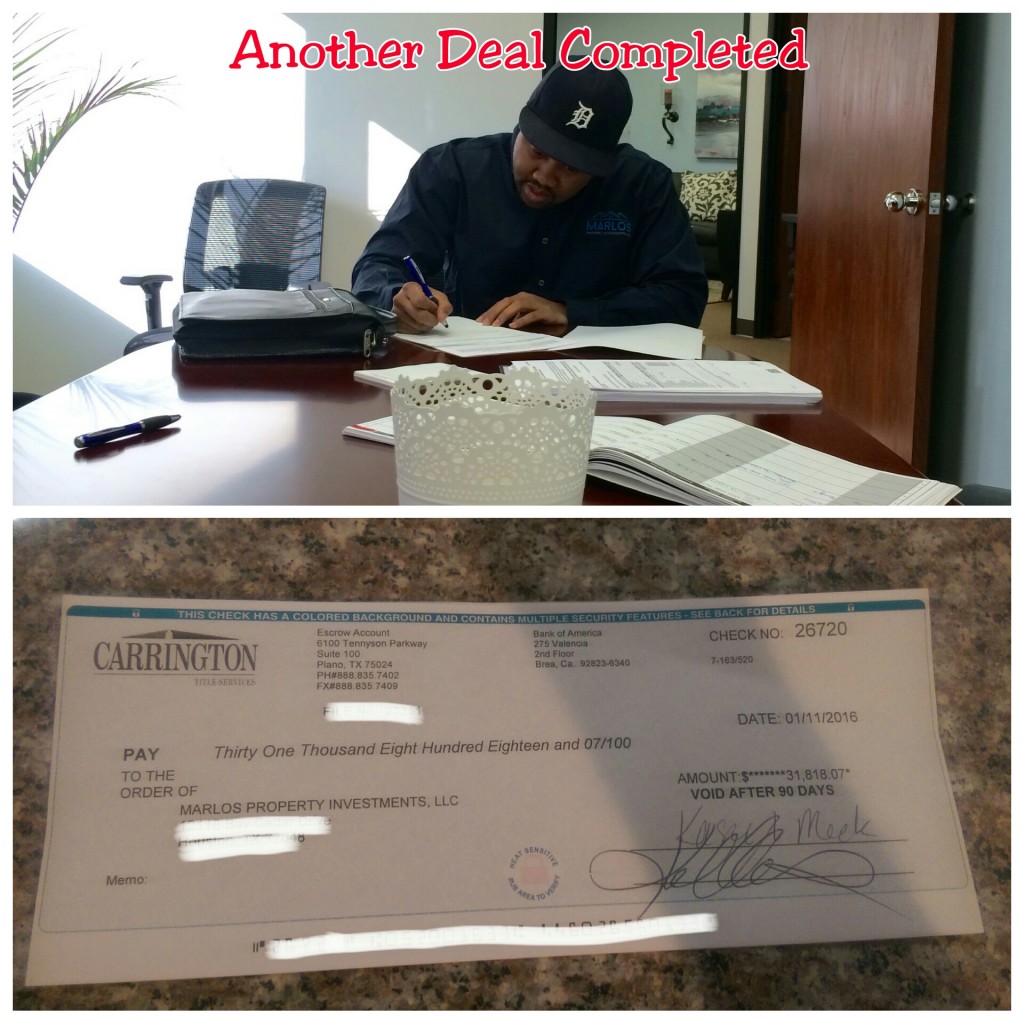

Real Estate Marlon- Another Deal Closed!

by

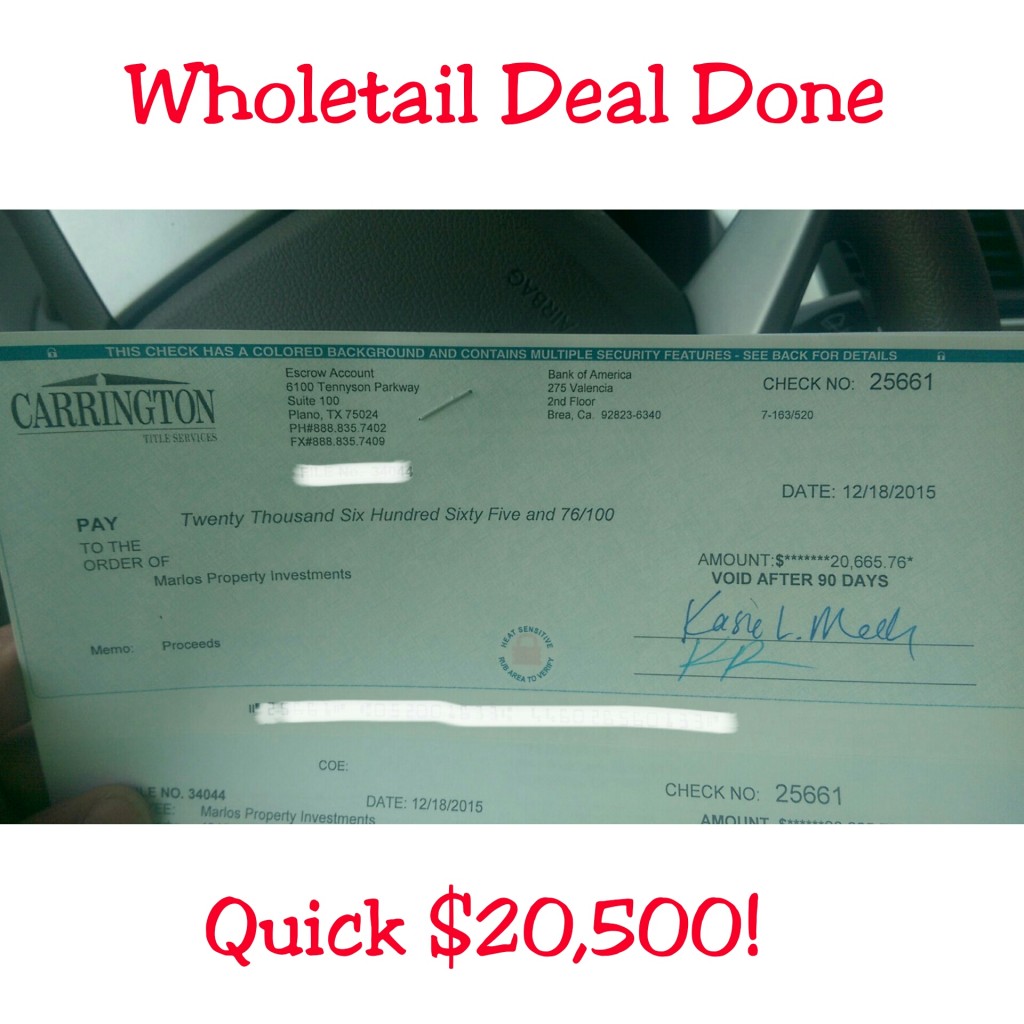

Real Estate Marlon- Every Day is Christmas!

by

Whats Houston’s Third Quarter Looking Like?

by

Houston needs more multifamily, and office is seeing its most prosperous cycle in more than 30 years, real estate experts at CBRE Group Inc.’s (NYSE: CBG) Houston office said at a quarterly press luncheon Tuesday.

Simmi Jaggi, first vice president with CBRE’s land group, noted the latest trend among master-planned communities in the area is the land tracts surrounding them are going to greatly benefit.

“If you are an owner in a hot spot with premium property, you’re getting premium pricing,” she said. “Land across all industries is hot, and retail has just caught up.”

Alex Makris, senior associate of the retail group, expanded on the sector’s pent-up demand with grocery being a big player in “power center development.”

Some strong retail nodes in Houston, like Willowbrook and the Westheimer corridor between the Beltway 8 and Eldridge, are likely to see some revitalization.

On the property assessment front, Steve Duplantis, senior managing director of the South Central region of CBRE Valuation & Advisory Services Group, said that many properties in Houston have been under-assessed, and some tax increases within the last quarter are reasonable.

Sanford Criner, executive vice president, mentioned this is an interesting time in the downtown office market because there is very little difference between rates being charged on existing Class A buildings and rates at brand-new buildings.

“I see a relatively healthy office market,” he said. “I’m not seeing development at a pace that we can’t absorb.”

Shaina Zucker covers commercial and residential real estate, construction, retail and hospitality for the Houston Business Journal. For her breaking stories and industry insights, follow her on Twitter.

I am a Real Estate Investor/Entrepreneur that lives and invest in Houston,Tx. Owner of Marlos Property Investments, LLC , a property investment company that focuses on residential property aquistions and rentals.

I am a Real Estate Investor/Entrepreneur that lives and invest in Houston,Tx. Owner of Marlos Property Investments, LLC , a property investment company that focuses on residential property aquistions and rentals.